Rite Aid (NYSE:RAD) has been a roller coaster ride over the past decade, with the company having faced a plethora of issues from a major economic downturn in the pharmacy space to internal issues with poor management.

In my last article, I highlighted some of the key management issues facing Rite Aid at that time. I also correctly surmised that Rite Aid would be a buyout target by Walgreens (NASDAQ:WBA).

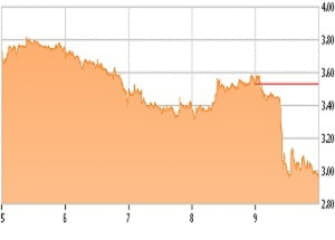

Shortly after my article published, Rite Aid and Walgreens announced a merger agreement in October 2015 where Walgreens would agree to pay $9 per share for Rite Aid. Many investors were overjoyed by this news, since the share price of Rite Aid had been deteriorating after a poor earnings report just weeks prior. At the time, it appeared that investors had finally reached the promised land after years of misery and dismal stock performance.

READ FULL ARTICLE HERE