Since Warren Buffett founded Berkshire Hathaway (NYSE:BRK-A) (NYSE:BRK-B) in 1965, the holding company's return has crushed the overall market. So, a cottage industry has been built on following the stock buys and sells of the legendary investor.

Even Buffett's biggest fans, however, should look beyond Berkshire's portfolio for investment ideas. The holding company's immense size -- its $424 billion market cap makes it the sixth-largest stock on the S&P 500 -- means Buffett and his team, who favor a concentrated portfolio, are forced to generally limit their new investments to very large companies. If they invested in anything smaller, it would be nearly impossible for them to buy enough shares to move the needle for Berkshire without driving up their own purchase price.

One stock with strong long-term return potential that Buffett would probably pass over due in part to its size is American Water Works (NYSE:AWK). Though it's the largest publicly traded water and wastewater utility in the United States, it has a relatively modest market cap of $14.3 billion.

IMAGE SOURCE: GETTY IMAGES.

American Water's returns have left Berkshire's returns high and dry

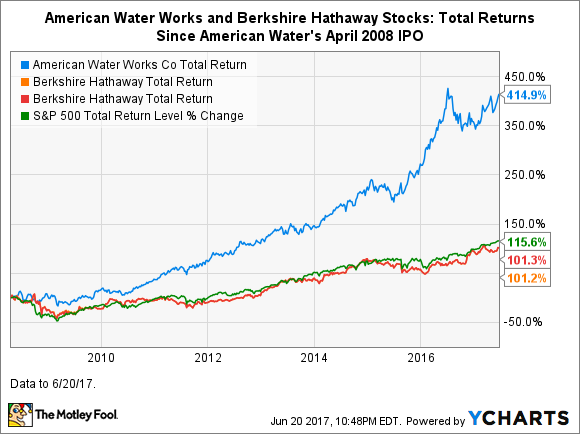

Since its April 2008 IPO, American Water Works stock's total return has crushed those of the overall market and both classes of Berkshire Hathaway stock, which has trailed the market.)

American Water stock has also outperformed Berkshire over shorter time periods, including every annual-increment period from two through seven years. While American Water stock is trailing Berkshire over the one-year period through June 20, it has been coming back strong in 2017, and is whipping Buffett and team so far this year.

DATA BY YCHARTS.

American Water has some "Buffett stock" traits

While American Water might not be the quintessential "Warren Buffett" stock, the company does have select traits that he is known to favor. These include:

- It pays a dividend.

- It has a strong moat.

- It provides a "forever product/service."

Shares of Berkshire Hathaway don't pay dividends, however, one need only quickly glance at Berkshire's stock holdings to see that Buffett favors dividend-paying stocks. American Water stock currently yields 2.04%, and the company has raised its dividend every year since it went public. Along with announcing solid first-quarter earnings in May, the company also announced a juicy 10.7% dividend hike.

Buffett likes companies with strong moats that can keep competitors at bay, and American Water has one. Its core business is both a regulated and natural monopoly. (A natural monopoly is a monopoly in an industry in which high infrastructure costs and other barriers to entry relative to the size of the market make it very unlikely new competitors will enter it, even if they're legally able to do so.) Moreover, the company's industry-leading size and geographic diversity provide it with a significant competitive advantage over other industry players when it comes to making acquisitions. Its size provides it with greater resources than its smaller industry peers, while its greater geographic diversity means it has more opportunities to expand in regions near where it currently operates, resulting in economies of scale.

Buffett is known to favor investing in companies that provide a product or service that he believes is going to be in demand forever -- or at least for a very long time. There's no product more essential to our survival than fresh drinking water. And wastewater treatment services have to rank high as among the most critical services in developed countries.

One up on Warren

The traits just discussed make great reasons for individual investors to consider investing in American Water Works stock.

As an individual investor, you have one notable advantage over the likes of Warren Buffett and professional fund managers who handle humongous sums of money: You can buy enough shares in small or medium-sized companies to make a difference in your portfolio's returns.

10 stocks we like better than American Water Works

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now… and American Water Works wasn't one of them! That's right -- they think these 10 stocks are even better buys.