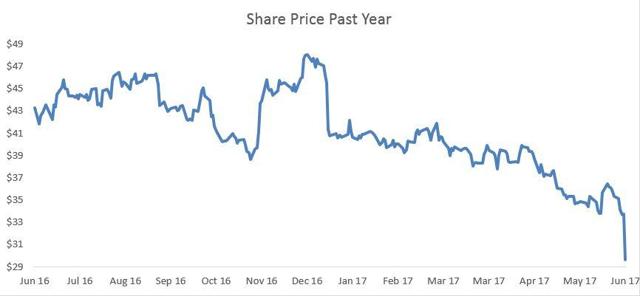

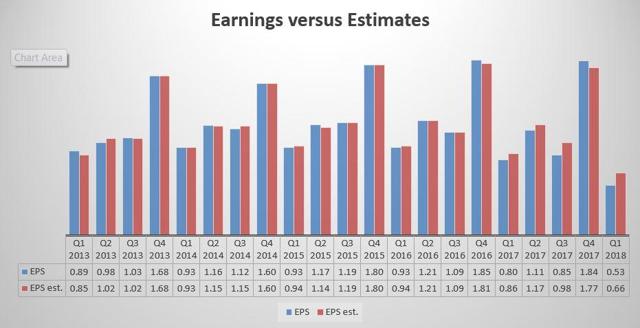

Bed, Bath, and Beyond (BBBY) shares plummeted on Friday after the retailer reported disastrous earnings after the prior day’s trading action. The first quarter earnings miss marks the fourth quarter in the previous five that the company has failed to meet earnings expectations. Friday’s selloff leaves Bed, Bath, and Beyond more than 31% lower than this time a year ago. Is Bed, Bath, and Beyond’s new 52-week low a buying opportunity or are the operational metrics pointing to a lower valuation?

Bed, Bath, and Beyond’s relationship between its earnings growth and revenue growth is alarming. While revenue growth is rather flat, earnings growth has been negative for five consecutive quarters with the current -6% being the worst. Earnings growth underperforming revenue growth is a leading indicator that management is either struggling to control costs or control prices. Considering that inflation in the retail sector is low, I believe that the problem lies in the company’s pricing strategy.