Comcast (NASDAQ:CMCSA) stock has provided big returns for long-term shareholders. The company has transformed itself several times and has become a stalwart in the cable industry. Here's a look at the history of the company, its stock, and what might be in store next.

Comcast stock and how it got here

When Comcast became a public company in 1972, it was a small cable TV provider with a few thousand subscribers. A $1,000 investment made in the summer of 1972 is worth more than $2.4 million today, more than a 245,000% return with dividends reinvested.

DATA BY YCHARTS.

Comcast is now the world's largest media conglomerate by revenue, combining Comcast's TV, internet, and phone businesses with NBC Universal's entertainment production, news, and theme-park businesses. Here's a look at some of the big moments in the company's history.

| Year | Event |

|---|---|

| 1963 | Comcast is founded with 1,200 cable subscriptions in Tupelo, Miss. |

| 1972 | The company issues its first publicly traded shares, raising about $3 million in capital. |

| 1986 | A 26% interest in Group W Cable is taken, doubling Comcast's subscribers and setting off a series of cable TV acquisitions that continue through the 1990s. |

| 1986 | Comcast issues a non-voting share class, CMCSK, in addition to the CMCSA voting shares. Up until 2015, every time the company splits its stock or issues new shares, shareholders receive new shares of CMCSK. |

| 1997 | Microsoft invests $1 billion in Comcast, betting on the possibilities cable will open up for technology. |

| 2002 | AT&T Broadband is acquired for $72 billion and more than doubles Comcast's subscribers to over 21 million. |

| 2008 | Comcast pays its first quarterly dividend, totaling $0.0625 per share. The dividend has been raised every year since initiation and now stands at $0.315 per share, adjusting for stock splits. |

| 2011 | NBC Universal is acquired from General Electric, combining Comcast's cable businesses with NBC Universal's entertainment and media conglomerate. The remaining 49% of NBC Universal is purchased from GE in 2013. |

| 2015 | Non-voting CMCSK stock is eliminated and reclassified as voting CMCSA shares on a one-for-one basis. |

| 2017 | CMCSA undergoes a 2-for-1 stock split. |

DATA SOURCE: COMCAST. CHART BY AUTHOR.

What Comcast is planning next

Cable, once a high-growth industry that helped Americans bundle TV, phone, and internet service, has run its course. Consumers are increasingly relying on 4G mobile packages to provide them with their communication and entertainment needs.

Comcast thus recently announced a partnership with Charter Communications to begin offering mobile service. Verizon will provide the 4G network, but Comcast's value proposition is to allow subscribers to also make use of its 16 million nationwide hot spots for data. The service is being offered at a discount for current customers, adding another option to Comcast's bundled packages.

COMCAST CENTER IN PHILADELPHIA. IMAGE SOURCE: COMCAST.

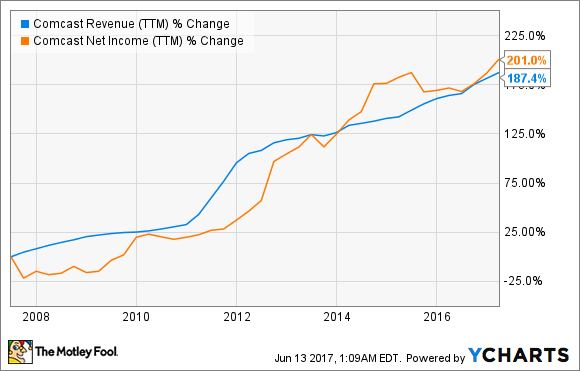

It remains to be seen if this is the next big thing that could propel Comcast stock even higher, especially after the strong returns since 2009. That said, Comcast still looks like a solid pick for the long-term investor. The company has amassed a track record of steadily increasing revenue and profit, proving itself resilient even during the worst of the financial crisis.

DATA BY YCHARTS.

Comcast's dividend certainly isn't a high yielder at about 1.5%, but the dividend's short history is one of expansion. Share prices tend to follow dividends higher, so if that trend continues, it bodes well for shareholders.

Now a heavyweight with a market cap of $194 billion, Comcast probably has its highest growth days behind it. Don't write the cable giant off, though. Its well-diversified business, spanning technology and entertainment, could still provide growth in investors' portfolios.