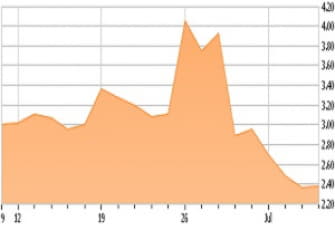

Private equity firms are already looking at Rite Aid (NYSE:RAD) as a value play. Cerberus Capital, a well-known private equity giant, already expressed interest in acquiring a large portion of Rite Aid's stores during the merger process. Other private equity firms have been looking for reasons that are obvious and not so obvious. One of the ever so obvious reasons is the drastically dropping stock price. There does not appear to be an end to the daily red in the Rite Aid chart. Be assured that this too shall pass, not because Rite Aid is out of business, but due to the shortage of sellers who were looking for a quick buyout price.

Let's face it; tens of millions of shares were trading in the weeks preceding the great FTC decision deadline. The hopeful speculators, me included, were doing some math calculations with $6.5-7 buyout price vs. a decline from $3 to possibly $2. Unfortunately for Rite Aid investors and speculators, Walgreens Boots Alliance (NASDAQ:WBA) got cold feet after 20 months of FTC indecision and found a better way to help itself to a chunk of Rite Aid. Unlike many other speculators, I did not sell one share after the new deal was announced. The reason is simple; I still believe that Rite Aid is worth $6.5 a share and so does private equity. In fact, PE was only able to express interest in parts of Rite Aidduring the merger process, unless it wanted a war with Walgreens, and now it can vie for the entire asset lot.

READ FULL ARTICLE HERE