Investment Thesis

Teva (TEVA) is a highly-leveraged company which faced a large one-off goodwill impairment which caused its share price to fall to decade lows. I humbly feel that this is a great opportunity for investors to participate in this FCF generative business without paying a large price for its shares.

Financials

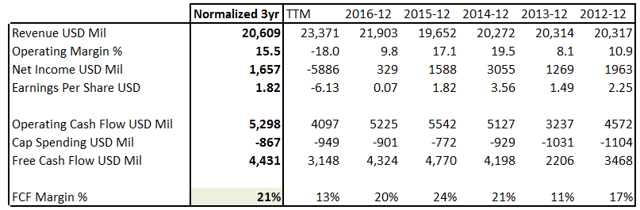

(Source: morningstar.com; author's calculations)

Two quite remarkable aspects should stick out from Teva's financials. Firstly, how steady its revenue has been growing in the past 5 years with a CAGR of 3.7%. Secondly, just how FCF generative this generics business is. It is quite remarkable. Which, in spite of having a significant amount of debt, which stands at just under $35 billion in net debt, it is quite a stable business. Please note, I am not referring to its share price, I'm solely referring to its FCF generation capacity. Paying up just over $17 billion market cap for something that has generated north of $3 billion in FCF over the past 3 years puts its stock price to FCF on less than 6 times multiple, which I believe to be unjustified when we consider the stability of its business.