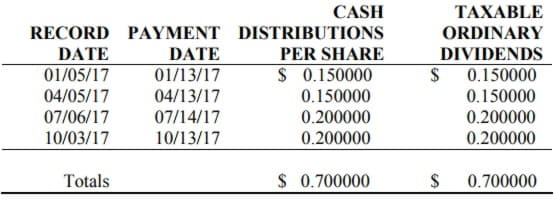

Mack-Cali Realty Corporation (NYSE: CLI) today announced the tax treatment of its 2017 dividends. The Company’s total distribution of $0.70 per share of common stock (CUSIP #554489104) is to be classified for income tax purposes as follows:

The fourth quarter 2017 distributions being made to shareholders of record as of January 3, 2018 are considered 2018 distributions for federal income tax purposes. Shareholders are encouraged to consult with their tax advisors as to their specific tax treatment of Mack-Cali Realty Corporation dividends.

About Mack-Cali Realty Corporation

One of the country's leading real estate investment trusts (REITs), Mack-Cali Realty Corporation is an owner, manager and developer of premier office and multifamily properties in select waterfront and transit-oriented markets throughout the Northeast. Mack-Cali is headquartered in Jersey City, New Jersey, and is the visionary behind the city's flourishing waterfront, where the company is leading development, improvement and place-making initiatives for Harborside, a master-planned destination comprised of class A office, luxury apartments, diverse retail and restaurants, and public spaces.

A fully-integrated and self-managed company, Mack-Cali has provided world-class management, leasing, and development services throughout New Jersey and the surrounding region for two decades. By regularly investing in its properties and innovative lifestyle amenity packages, Mack-Cali creates environments that empower tenants and residents to reimagine the way they work and live.

For more information on Mack-Cali Realty Corporation and its properties, visit www.mack-cali.com.